If you have benefited from Honda Financial Services Payments, you likely need to pay your Honda automobile loan in the manner that is easiest for you, if you have one. You can be attempting to find flexibility or maybe the option to pay cash.

Welcome to a journey of financial empowerment designed exclusively for our valued Honda car owners. At Honda, we understand that owning a car is not just about the thrill of the ride; it’s about the entire experience, and that includes the financial aspects. This comprehensive guide is your key to unlocking financial freedom through a deep dive into Honda Financial Services payments.

Why is this guide essential for you?

Owning a Honda isn’t just a choice; it’s a lifestyle. We recognize that navigating the financial landscape of car ownership can be as crucial as choosing the perfect model. In this introduction, we invite you to embark on a voyage where financial clarity and convenience converge.

A. Welcoming Honda Car Owners to Financial Empowerment

As a proud Honda car owner, you’re not just part of a community; you’re part of a legacy. We want to ensure that your experience goes beyond the road, encompassing every facet of your ownership journey. This guide is crafted with you in mind, offering insights, tips, and practical advice to make managing your Honda Financial Services payments a seamless and empowering experience.

B. Brief Overview of Honda Financial Services Payments

What lies ahead? This section provides a sneak peek into the topics we’ll be exploring. From understanding the role of Honda Financial Services in your ownership journey to unraveling the intricacies of payment options, consider this guide your roadmap to financial well-being. Whether you’re a seasoned Honda owner or a first-time buyer, this introduction sets the stage for an enlightening exploration of managing your Honda Financial Services payments with confidence and ease.

Get ready to discover the keys to financial success in your Honda ownership journey and Honda Financial Services payments:

Understanding Honda Financial Services

Embark on a journey to unravel the essence of Honda Financial Services, the backbone of your Honda ownership experience. In this section, we’ll delve into the core aspects, shedding light on how Honda Financial Services operates and the array of benefits it brings to you as a Honda car owner.

A. Introduction to Honda Financial Services

- Navigating the Financial Landscape: Let’s start by demystifying the world of automotive financing. Honda Financial Services is more than a payment gateway; it’s a tailored financial solution designed to make your ownership experience smooth and worry-free. We’ll explore how it goes beyond traditional financing, offering flexibility and convenience.

B. Benefits of Choosing Honda Financial Services

- Tailored Financing Plans: Discover how Honda Financial Services customizes its financing plans to suit your unique needs. Whether you’re aiming for lower monthly payments or the flexibility to upgrade, we’ll uncover the options that put you in the driver’s seat of your financial journey.

- Exclusive Honda Loyalty Programs: As a token of appreciation for your loyalty, Honda Financial Services extends exclusive programs and benefits. From loyalty discounts to priority services, this subsection explores how your commitment to Honda is reciprocated in your financial experience.

C. The Role of Honda Financial Services in Your Ownership Journey

- Beyond Payments: Honda Financial Services is not just about payments; it’s about enhancing your overall ownership experience. Learn how it contributes to the broader aspects of maintenance, insurance, and the seamless transition between different Honda models.

D. Clearing the Myths Around Financing

- Debunking Common Misconceptions: Financing can be intimidating, but it doesn’t have to be. This part of the section tackles common myths around financing, providing clarity and dispelling any misconceptions that might hinder your financial confidence.

From understanding the foundations to exploring the unique benefits, this section is your compass to navigate the world of Honda Financial Services with confidence and clarity. Get ready to redefine your financial journey as a Honda car owner!

Managing Your Honda Financial Account

Now that we’ve laid the groundwork for understanding Honda Financial Services, it’s time to dive into the practicalities of managing your account. This section equips you with the knowledge and tools needed to navigate your Honda Financial account seamlessly.

Accessing Your Online Account

- Setting Up Your Online Profile: Explore the step-by-step process of setting up your online account. From registration to navigating the dashboard, this subsection ensures you’re well-versed in leveraging the digital platform for account management.

- Benefits of Online Account Management: Uncover the advantages of managing your Honda Financial account online. Whether it’s accessing statements, making payments, or exploring exclusive offers, this part emphasizes the convenience and efficiency of the digital realm.

Understanding Billing and Payment Options

- Billing Statements Demystified: Break down your billing statements and understand the key components. From interest rates to due dates, we’ll simplify the information presented on your statements, empowering you to make informed financial decisions.

- Payment Options for Every Lifestyle: Explore the array of payment options Honda Financial Services provides. Whether you prefer autopay, manual payments, or exploring bi-weekly payment plans, this subsection guides you in choosing the option that aligns with your lifestyle.

Navigating Special Financial Situations

Financial Hardship Assistance: Life is unpredictable, and sometimes financial challenges arise. Learn how Honda Financial Services supports you during challenging times, offering assistance programs and solutions designed to ease the burden.

Maximizing Discounts and Rewards

- Exclusive Discounts for Honda Owners: Delve into the world of exclusive discounts and rewards available to Honda owners. From loyalty rewards to special financing rates, this part reveals how your Honda ownership can translate into tangible financial benefits.

Armed with the knowledge of managing your Honda Financial account effectively, you’re empowered to take control of your financial journey. From online tools to tailored payment options, this section ensures you make the most of the resources at your disposal. Get ready to elevate your financial management game with Honda Financial Services!

Navigating Honda Financial Services Website

As we journey deeper into understanding Honda Financial Services, it’s essential to master the art of navigating their website. This section serves as your compass, guiding you through the digital landscape and helping you make the most of the resources available.

A. User-Friendly Interface

- Introduction to the Website: Get acquainted with the Honda Financial Services website. We’ll explore the homepage, highlighting key sections and features designed to enhance your online experience.

- Creating an Account: If you haven’t already, discover the process of creating an online account. We’ll provide a step-by-step guide, ensuring a smooth registration process and access to your personalized dashboard.

B. Exploring Your Account Dashboard

- Dashboard Features: Uncover the functionalities of your account dashboard. From viewing statements to tracking payment history, this subsection provides an in-depth tour of the features that empower you to manage your Honda Financial account with ease.

- Mobile App Overview: In an era of on-the-go living, explore the Honda Financial Services mobile app. Learn how it extends the convenience of account management to your fingertips, allowing you to stay connected wherever life takes you.

C. Utilizing Online Tools and Resources

- Payment Calculators: Delve into the online tools available, such as payment calculators. Understand how these tools assist you in estimating payments, exploring financing options, and planning your financial journey with your Honda vehicle.

- Educational Resources: Honda Financial Services goes beyond transactions; it’s committed to empowering you with knowledge. Discover the educational resources available on the website, from articles on financial wellness to FAQs that address common queries.

D. Troubleshooting and Support

- Customer Support Channels: Sometimes, questions arise. This part outlines the various customer support channels provided by Honda Financial Services. Whether it’s a technical issue or a financial inquiry, we guide you on reaching out for assistance.

- Common Troubleshooting Tips: Equip yourself with common troubleshooting tips. From login issues to navigating specific sections, we’ve got you covered with solutions to potential challenges you might encounter on the website.

By the end of this section, you’ll be not just a Honda car owner but a proficient navigator of the Honda Financial Services digital landscape. Let’s embark on a virtual tour, ensuring you harness the full potential of the online platform for a seamless and empowered financial journey.

Honda Financial Services Payment Options

Now, let’s delve into the heart of the matter – ensuring your Honda Financial Services payments are as convenient as your driving experience. This section is your comprehensive guide to understanding the diverse payment options available, making the financial aspect of owning a Honda a stress-free affair.

A. Traditional Payment Methods

- Mail-In Payments: Explore the classic method of sending payments via mail. We’ll walk you through the steps, ensuring your mailed payments reach the right destination promptly.

- In-Person Payments: For those who prefer a personal touch, discover the option of making payments in person. We’ll provide insights into authorized payment locations, ensuring a hassle-free transaction.

B. Online Payment Platforms

- Honda Financial Services Website: Uncover the convenience of making payments directly through the official website. We’ll guide you on accessing the payment portal, ensuring a secure and straightforward online transaction.

- Mobile App Payments: In an era of digital dominance, the Honda Financial Services mobile app offers a seamless payment experience. Learn how to navigate the app’s payment features and execute transactions with just a few taps on your device.

C. Autopay Services

- Setting Up Autopay: Simplify your life with autopay services. We’ll provide a step-by-step guide on setting up autopay, ensuring that your payments are automatically deducted, eliminating the risk of late fees.

- Autopay Benefits: Understand the advantages of autopay beyond the obvious time-saving element. From ensuring timely payments to potentially accessing special benefits, discover why autopay might be the ideal choice for you.

D. Exploring Financing Options

- Flexible Financing Plans: Beyond the routine payments, this subsection sheds light on the various financing options available. Whether you’re looking to refinance or explore unique plans, we’ll guide you through the decision-making process.

- Understanding Interest Rates: Dive into the intricacies of interest rates. We’ll break down the information, empowering you to make informed decisions regarding financing that align with your financial goals.

By the end of this section, you’ll not only be well-versed in the myriad payment options offered by Honda Financial Services but also equipped to choose the method that best suits your lifestyle and preferences. Your Honda journey is not just about driving; it’s about enjoying every aspect, including the financial convenience that comes with it. Let’s ensure your payments align with the seamless Honda experience.

Tips for Budget-Friendly Honda Ownership

Owning a Honda is more than just a transaction; it’s a commitment to a brand that values efficiency, reliability, and innovation. In this section, we’ll explore practical tips and strategies to make your Honda ownership experience not only enjoyable but also budget-friendly.

A. Regular Maintenance Guidelines

- Scheduled Maintenance: Understand the importance of adhering to Honda’s recommended maintenance schedule. We’ll guide you through the routine checks and services that ensure your vehicle’s longevity and optimal performance.

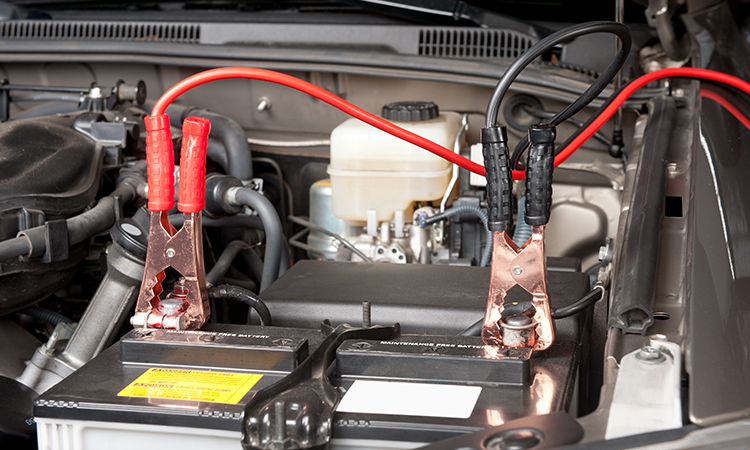

- DIY Maintenance Tips: Discover some simple do-it-yourself maintenance tasks that can save you money. From basic fluid checks to minor replacements, we’ll empower you to handle certain aspects without the need for professional assistance.

B. Fuel Efficiency Hacks

- Optimizing Fuel Efficiency: Explore driving habits and vehicle maintenance practices that contribute to better fuel efficiency. We’ll provide insights into factors like proper tire inflation, regular engine checks, and efficient driving techniques.

- Utilizing Honda Eco Assist: Learn how to leverage Honda’s Eco Assist system to enhance fuel efficiency. We’ll delve into the functionalities of this feature and how it can positively impact your overall fuel consumption.

C. Insurance Cost Management

- Comparing Insurance Plans: Navigate the world of car insurance with tips on comparing plans and securing the best coverage for your Honda. We’ll guide you through factors to consider, ensuring you strike the right balance between coverage and cost.

- Discount Opportunities: Uncover potential discounts that may be available to Honda owners. From safe driver discounts to bundling options, we’ll help you explore avenues to reduce insurance costs.

D. Resale Value Enhancement

- Effective Maintenance Records: Understand the significance of maintaining thorough records of your Honda’s maintenance history. We’ll discuss how organized records can positively influence the resale value of your vehicle.

- Upkeep of Exterior and Interior: Explore simple yet impactful ways to keep your Honda’s exterior and interior in top condition. From regular cleaning routines to protective measures, we’ll guide you on preserving your vehicle’s aesthetic appeal.

E. Exploring Honda Owner Benefits

- Leveraging Owner Programs: Discover special programs and initiatives offered by Honda that can contribute to cost savings. From loyalty programs to exclusive owner benefits, we’ll highlight avenues for maximizing your ownership experience.

- Participating in Honda Events: Engage with the vibrant Honda community by participating in events and gatherings. We’ll discuss the potential benefits, including networking opportunities and access to exclusive promotions.

As we delve into these budget-friendly tips for Honda ownership, our goal is to ensure that your journey with Honda is not only smooth on the road but also light on your wallet. Let’s navigate the realm of practical strategies that enhance your ownership experience, making it both enjoyable and economical.

Honda Financial Services vs. Other Financing Options

When it comes to financing your Honda, it’s essential to explore the various options available in the financial landscape. In this section, we’ll compare Honda Financial Services with other financing alternatives, empowering you to make an informed decision that aligns with your financial goals.

A. Understanding Honda Financial Services

- Exclusive Honda Benefits: Delve into the unique advantages offered by Honda Financial Services. We’ll explore tailored financing plans, flexible terms, and special promotions that distinguish Honda’s in-house financing from other options.

- Honda Lease Options: Learn about Honda’s leasing programs and how they differ from traditional financing. We’ll discuss the benefits of leasing, such as lower monthly payments and the opportunity to drive a new Honda more frequently.

B. Traditional Auto Loans

- Bank and Credit Union Loans: Explore the option of securing an auto loan from banks or credit unions. We’ll guide you through the application process, interest rate considerations, and the implications of choosing external financing.

- Loan Comparison: Understand the key differences between Honda Financial Services loans and those offered by traditional financial institutions. We’ll highlight aspects like interest rates, loan terms, and eligibility criteria.

C. Online Lenders and Financing Platforms

- Digital Financing Solutions: Investigate the rise of online lenders and financing platforms. We’ll discuss the convenience of digital applications, potential benefits, and factors to consider when exploring these modern financing avenues.

- Comparing Terms and Rates: Delve into a comparative analysis of terms and interest rates offered by online lenders in contrast to Honda Financial Services. We’ll help you navigate the digital financing landscape effectively.

D. Dealership Financing Offers

- Manufacturer Promotions: Understand how dealership financing, often facilitated by manufacturers, operates. We’ll explore promotional offers, incentives, and potential savings that might be available when financing through a dealership.

- Dealer Incentives: Discover any additional incentives or perks that dealerships may offer when you choose their financing options. We’ll provide insights into negotiating favorable terms as part of your overall vehicle purchase.

E. Customer Reviews and Satisfaction

- User Experiences: Explore customer reviews and satisfaction levels associated with Honda Financial Services and other financing alternatives. We’ll discuss the importance of real-world experiences in shaping your decision-making process.

- Online Comparisons: Navigate online platforms that aggregate customer reviews and feedback for various financing providers. We’ll guide you on leveraging these resources to gain valuable insights.

As we delve into the comparison between Honda Financial Services and other financing options, our aim is to equip you with the knowledge needed to choose the pathway that aligns seamlessly with your preferences and financial objectives. Let’s navigate the diverse landscape of auto financing to ensure you embark on your Honda ownership journey with confidence and clarity.

VIII. Success Stories: Real Experiences with Honda Financial Services

Embark on a journey through real-life narratives of individuals who have chosen Honda Financial Services for their automotive financing needs. In this section, we’ll present success stories that highlight the positive experiences, unique benefits, and overall satisfaction of Honda car owners with the financial services provided by the brand.

A. Tailored Financing Solutions

- Case Study 1: Tailored for Every Need: Explore a success story where a Honda owner shares their experience with the personalized financing solutions offered by Honda Financial Services. Understand how the flexibility of terms and tailored plans met their specific financial requirements.

- Case Study 2: Overcoming Financial Hurdles: Delve into a narrative where a Honda owner faced financial challenges and found effective solutions through Honda Financial Services. Learn how the brand’s commitment to customer support played a pivotal role in overcoming obstacles.

B. Seamless Online Experience

- Case Study 3: Navigating the Online Portal: Discover a firsthand account of a Honda car owner’s experience with the online services provided by Honda Financial. Explore the ease of managing accounts, making payments, and accessing essential financial information through the digital platform.

- Case Study 4: Paperless Transactions: Uncover a success story that emphasizes the convenience of paperless transactions facilitated by Honda Financial Services. Learn how the integration of technology streamlined the financial aspects of Honda ownership.

C. Exceptional Customer Support

- Case Study 5: Going Beyond Expectations: Hear from a Honda owner who encountered a unique situation and experienced exceptional customer support from Honda Financial Services. Understand how the brand’s commitment to going beyond expectations left a lasting impression.

- Case Study 6: Navigating Challenges Together: Explore a narrative where a Honda car owner faced unexpected challenges, and Honda Financial Services played a crucial role in navigating and resolving the issues. Learn about the support system that extends beyond the financial transaction.

D. Testimonials of Satisfaction

- Testimonial 1: A Smooth Financing Journey: Read a testimonial from a satisfied Honda car owner who found the financing process with Honda Financial Services to be remarkably smooth. Gain insights into the aspects that contributed to a positive overall experience.

- Testimonial 2: Building Trust Through Transparency: Explore a testimonial that highlights the importance of trust and transparency in the relationship between Honda Financial Services and its customers. Understand how clear communication and openness contribute to customer satisfaction.

By delving into these success stories and testimonials, we aim to provide you with a firsthand understanding of the positive experiences that Honda car owners have encountered with Honda Financial Services. These real narratives serve as a testament to the brand’s commitment to delivering excellence in automotive financing, ensuring that you can make informed decisions as you consider your own financing journey with Honda.

Staying Informed: Updates and Changes to Honda Financial Services

In this section, we’ll explore the importance of staying informed about updates, changes, and any new offerings from Honda Financial Services. Ensuring that Honda car owners are up-to-date with the latest developments is crucial for a seamless and well-informed financial journey. Let’s dive into the key aspects:

A. Notifications and Alerts

- 1. Personalized Notifications: Understand how Honda Financial Services provides personalized notifications to keep car owners informed about account updates, upcoming payments, and any changes to their financing arrangements. Explore the benefits of receiving timely alerts for a hassle-free financial experience.

- 2. App-Based Alerts: Delve into the convenience of app-based alerts, where Honda car owners can receive real-time updates directly on their mobile devices. Learn how this feature enhances accessibility and ensures that users are always in the loop.

B. Policy Changes and Enhancements

- 1. Policy Updates: Explore how Honda Financial Services communicates policy changes and enhancements to its customers. Understand the transparency in sharing information about alterations to financing terms, conditions, and any additional features introduced.

- 2. Enhanced Services: Learn about any newly introduced services or enhancements that Honda Financial Services may offer to its customers. This could include improved online tools, additional support services, or innovative features aimed at enhancing the overall financial experience.

C. Customer Education Initiatives

- 1. Webinars and Resources: Discover how Honda Financial Services engages in customer education initiatives, such as webinars and informative resources. Explore the brand’s commitment to ensuring that car owners have access to valuable information that empowers them to make informed financial decisions.

- 2. Dedicated Support Channels: Understand the availability of dedicated support channels through which Honda car owners can seek clarification, ask questions, and stay informed. Whether through customer support representatives or online resources, discover the various avenues for obtaining information.

D. Community Forums and Feedback Loops

- 1. Community Engagement: Explore how Honda Financial Services fosters community engagement among its customers. Learn about community forums where car owners can share experiences, seek advice, and stay informed about the financial aspects of Honda ownership through peer interactions.

- 2. Feedback Mechanisms: Understand the feedback mechanisms in place, allowing Honda car owners to express their thoughts, concerns, and suggestions. Discover how customer feedback contributes to the continuous improvement and evolution of Honda Financial Services.

By staying informed about updates and changes to Honda Financial Services, car owners can navigate their financial journey with confidence. This section aims to provide insights into the mechanisms through which Honda ensures that its customers are well-versed with the latest information, ensuring a transparent and informed relationship between the brand and its valued community of Honda car owners.

Common FAQs: Expert Answers to Honda Financial Queries

This section serves as a comprehensive resource for addressing common queries that Honda car owners may have about Honda Financial Services. By providing expert answers, we aim to offer clarity and assistance on various financial aspects. Let’s explore the frequently asked questions and their detailed responses:

A. Understanding Monthly Payments

- 1. How Are Monthly Payments Calculated? – Break down the factors that contribute to the calculation of monthly payments, including interest rates, loan terms, and any additional fees.

- 2. Can I Change My Monthly Payment Due Date? – Provide insights into the flexibility Honda Financial Services offers regarding changing the due date of monthly payments and the steps involved.

B. Early Payoff and Loan Terms

- 1. Is There a Penalty for Early Loan Payoff? – Clarify whether Honda Financial Services imposes penalties for customers who choose to pay off their loans before the agreed-upon term.

- 2. Can I Extend My Loan Term? – Explore the possibilities and considerations for extending the loan term and how it may impact monthly payments.

C. Account Management and Online Tools

- 1. How Can I Access My Account Online? – Guide users through the process of accessing their Honda Financial Services accounts online and the range of tools available for account management.

- 2. What Do I Do If I Forget My Account Password? – Provide step-by-step instructions on recovering a forgotten password and ensuring secure access to online accounts.

D. Lease-Related Inquiries

- 1. What Options Do I Have at the End of My Lease? – Outline the available options for customers approaching the end of their lease, such as lease renewal, purchasing the vehicle, or exploring new lease agreements.

- 2. Can I Transfer My Lease to Another Person? – Explain the process and considerations involved in transferring a Honda lease to another individual.

E. Financial Assistance and Hardship Programs

- 1. What Financial Assistance Programs Does Honda Offer? – Detail the financial assistance programs and hardship options that Honda Financial Services provides to customers facing challenges.

- 2. How Can I Apply for Hardship Support? – Provide clear guidance on the application process for hardship support, including necessary documentation and contact channels.

F. Vehicle Protection Plans and Insurance

- 1. What Does the Vehicle Protection Plan Cover? – Specify the coverage aspects of Honda’s Vehicle Protection Plan, offering insights into the protection it provides for the vehicle.

- 2. Can I Use My Own Insurance Provider? – Clarify the options available for customers in terms of using their preferred insurance providers and the associated requirements.

G. Contacting Honda Financial Services

- 1. What Is the Customer Service Contact Information? – Provide the official customer service contact details for Honda Financial Services, ensuring customers know where to reach out for assistance.

- 2. How Can I Provide Feedback or Raise Concerns? – Guide users on the process of providing feedback or raising concerns, emphasizing Honda’s commitment to addressing customer input.

XI. Exclusive Offers and Promotions

In this section, we delve into the exclusive offers and promotions that Honda Financial Services may extend to its customers. Highlighting special financing rates, loyalty programs, and promotional periods, we aim to keep Honda car owners informed about opportunities that enhance their ownership experience.

- 1. Are There Special Financing Rates for Honda Owners? – Detail any ongoing or seasonal special financing rates available exclusively for Honda car owners, emphasizing potential savings.

- 2. Loyalty Programs: How Do They Benefit Honda Owners? – Explore any loyalty programs that Honda Financial Services offers, elucidating the perks and advantages for customers who choose to stay within the Honda family.

- 3. Limited-Time Promotions: What Should Owners Look Out For? – Provide insights into any limited-time promotions or offers, ensuring that Honda car owners are aware of opportunities to optimize their financial arrangements.

XII. Future Planning with Honda Financial Services

This section focuses on the long-term financial planning aspects that Honda car owners may consider. From trade-in options to upgrading to newer models, we guide users on how to navigate their financial journey with Honda Financial Services.

- 1. Vehicle Trade-In: How Does It Work with Honda? – Explain the process of trading in a Honda vehicle, including potential benefits, considerations, and how it aligns with long-term financial planning.

- 2. Upgrading to a New Honda Model: What You Need to Know – Provide information on the process of upgrading to a newer Honda model, exploring the financial implications and steps involved.

XIII. Honda Financial Services Community and Resources

This section highlights the community aspect of Honda Financial Services, offering a glimpse into forums, blogs, and resources that foster a sense of community among Honda car owners. From shared experiences to expert insights, this segment adds a personal touch to the financial journey with Honda.

- 1. Online Forums and Communities: – Introduce online forums and communities where Honda car owners can connect, share experiences, and seek advice on financial matters related to vehicle ownership.

- 2. Blogs and Articles: – Showcase blogs and articles from Honda Financial Services that provide valuable insights, tips, and stories relevant to financial planning and ownership.

XIV. Honda Financial Services Mobile App

In this section, we explore the features and benefits of the Honda Financial Services mobile app. From convenient payment options to account management on the go, we showcase how the app enhances the overall customer experience.

- 1. Mobile App Features: – Outline key features of the Honda Financial Services mobile app, emphasizing its user-friendly interface, payment options, and real-time account access.

- 2. Benefits of Using the App: – Detail the advantages of using the mobile app, including streamlined payment processes, personalized notifications, and enhanced convenience.

Conclusion: Driving Financial Confidence with Honda

positioning Honda Financial Services not just as a financial service provider but as a trusted partner on the journey of Honda ownership. There are a number of ways to make a monthly payment to Honda, including making a payment through Honda Financial Services or using one of the other services that are offered. Check out all of your choices and pick the one that works best for you.

Sources:

https://www.hondafinancialservices.com/account-management/payment-options

https://www.hondafinancialservices.com/Registration/reg-step-two-acct-info

https://www.westernunion.com/us/en/pay-bills.html

https://www.moneygram.com/mgo/us/en/

https://www.speedpay.com/rmt/embedded

https://www.caranddriver.com/research/a31993240/how-to-buy-a-car-with-cash/