The insurance cost of Tesla Model 3 is a crucial factor to consider when assessing its overall affordability and ownership expenses. Neocarsuv aims to analyze the insurance cost associated with the Tesla Model 3, a popular electric vehicle renowned for its technological advancements and sustainability. By examining various factors that influence insurance rates, we can gain insights into the cost implications of insuring the Model 3 and understand how it compares to other vehicles in the market.

I. Factors Influencing Insurance Cost:

Several factors affect the insurance cost of the Tesla Model 3, including:

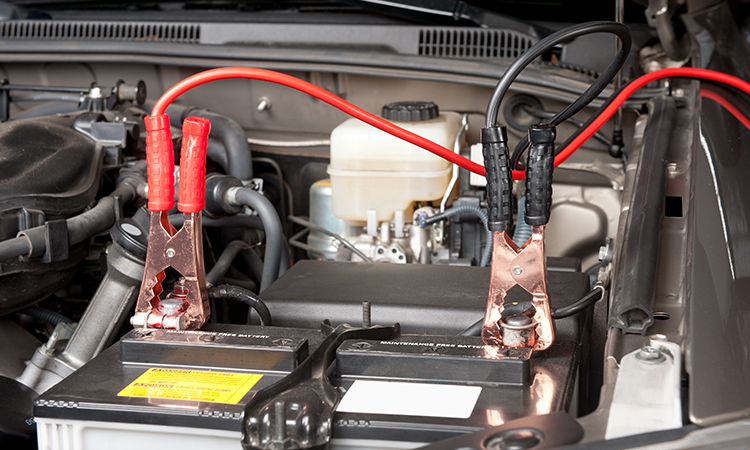

- Vehicle Value and Repair Costs:

The value of the Model 3, coupled with the costs of repair and replacement of its advanced components, can impact insurance rates. Electric vehicles like the Model 3 may have higher repair costs due to specialized parts and limited availability of repair facilities, potentially influencing insurance premiums. - Safety Features and Ratings:

The safety features and crash test ratings of the Model 3 play a significant role in determining insurance costs. The Model 3 has consistently received high safety ratings, such as 5-star overall ratings from the National Highway Traffic Safety Administration (NHTSA) and top ratings from independent safety organizations. These favorable safety ratings can result in lower insurance premiums. - Theft and Vandalism Rates:

Insurance providers consider the likelihood of theft and vandalism when determining insurance costs. While the Model 3’s advanced security features and tracking capabilities may reduce the risk of theft, the desirability and value of the vehicle may still influence insurance rates. - Driver Profile and Location:

Factors such as the driver’s age, driving history, and location can significantly impact insurance costs. Younger drivers or those with a history of accidents or traffic violations may face higher premiums. Additionally, insurance rates may vary depending on the region due to differences in local laws, traffic patterns, and accident rates.

II. Comparison with Other Vehicles:

When comparing the insurance cost of the Tesla Model 3 with other vehicles, it is important to consider the vehicle’s overall safety, value, and repair costs. While electric vehicles may have higher initial insurance costs due to their advanced technology and repair expenses, they may also qualify for insurance discounts and incentives aimed at promoting sustainable transportation.

III. Insurance Premium Mitigation Strategies:

There are several strategies that Tesla Model 3 owners can employ to potentially mitigate insurance premiums:

- Bundling Insurance Policies:

Combining multiple insurance policies with the same provider, such as home and auto insurance, may lead to cost savings through bundled discounts. - Driver Education and Safety Courses:

Completing driver education and safety courses can demonstrate responsible driving behavior and may result in lower insurance premiums. - Increasing Deductibles:

Opting for a higher deductible can help reduce insurance premiums, but it’s important to carefully consider the financial implications of potential out-of-pocket expenses in the event of a claim.

Conclusion:

The insurance cost associated with the Tesla Model 3 is influenced by various factors, including the vehicle’s value, repair costs, safety features, theft rates, driver profile, and location. While electric vehicles may have unique considerations, such as specialized repairs and limited availability of repair facilities, the Model 3’s strong safety ratings and advanced features can potentially lead to favorable insurance rates. Comparisons with other vehicles and the implementation of insurance premium mitigation strategies can further contribute to managing insurance costs associated with the Model 3. Understanding these factors provides valuable insights for potential Model 3 owners and contributes to a comprehensive evaluation of the vehicle’s affordability and long-term ownership expenses.